Buying a house in Northern Ireland

So you have your reasons for moving and buying a new house (bigger space, closer to work), but where do you start when buying a house in Northern Ireland?

Searching for a house in Northern Ireland

In what area should I buy a home in Northern Ireland?

To start the process, we highly recommend researching neighbourhoods and areas you think you would like to live. Arguably the most important aspect to research is the price of houses in that area. Where you hope to purchase your home is very closely linked to affordability – you will have to determine if you can afford to buy in your favourite location. More often than not, it all comes down to money.

You can find out the average cost of houses in certain areas instantly using websites such as zoopla.co.uk. These sites enable you to check the value on each street in Northern Ireland – whether it’s a street in Belfast, Ballymena or Boho. It is a good idea to buy in areas that are ‘on the up’, as houses are likely to increase in price as the area becomes more popular. This has been seen recently in areas such as Ballyhackamore in East Belfast.

If you are moving to an area you are not very familiar with, it is worth making a visit before you spend hours on property websites scrolling through endless ‘For Sale’ posts. Look out for any vacant or boarded up properties, empty retail units nearby and unkempt communal areas and roads. If we take Kirsty and Phil’s advice, it is really all about location, location, location.

Where do I search when buying a house Northern Ireland?

Once you have an idea of your desired neighbourhood and average house values in that area, you can then have a good look through the property listing websites. Inputting search criteria to find comparable prices according to the number of bedrooms, outside pace and square footage you desire.

There are countless property search websites in Northern Ireland, including the big comparable websites. However, it is important to check local estate agent websites as some properties may not be listed on the major sites;

www.propertypal.com

www.propertynews.com

www.ulsterpropertysales.co.uk

www.primelocation.com

www.propertysalesandlettingsni.com/

www.propertypeopleni.com/

www.propertypeopleni.com/

www.simonbrien.com

www.giantproperty.co.uk/

www.fetherstonclements.com

www.watterspropertysales.co.uk/

You can then shortlist houses you want to view that you think will meet your criteria. This is likely to be the longest step in the process. Like most online imagery, the real life product can look quite different. So you just have to get out there and view as many houses as you can.

When you have your location decided, selected houses to view and miraculously found a suitable home in budget (easy really!), the next step in buying a new house in Northern Ireland is to sort out your finances.

Securing a Mortgage in Northern Ireland

Credit Score

A simple but important starting point when searching for a mortgage is checking your credit score. Your credit score is what lenders see and will analyse when they receive your application for their mortgage. The higher your credit score is, the better your chances are of securing your mortgage and at a better rate.

You can access your credit report on:

Experian www.experian.co.uk/

Equifax www.equifax.co.uk/

Credit Expert www.creditexpert.co.uk

Is my credit score good enough to secure a mortgage?

The main credit websites can score differently, for example Experian score out of a total of 999 and Equifax is out of 700. With Experian, a credit score above 800 is generally considered good, and anything above 960 is excellent.

An excellent score with Equifax would be around 475.

Simple ways to improve your credit score include registering on the electoral roll and closing down any credit card accounts that are no longer used.

Mortgage Advisor

Most people will require a mortgage when buying a house, unless, of course, you have a lot of spare cash. A mortgage is simply a long term loan which is secured on your home. If you fail to make repayments, the mortgage provider can repossess your property.

Choosing a Mortgage Advisor in Northern Ireland

In order to get the best mortgage and save yourself a lot of research and leg work, use an independent Mortgage Advisor or Financial Advisor (IFA) who has an in-depth knowledge of the market. Ask friends and family for a referral for an advisor they may have had a positive experience with.

When choosing a Mortgage Advisor or Financial Advisor, ensure they are qualified and regulated by the Financial Conduct Authority (FCA). You can check if your Mortgage Advisor is registered with the FCA here; https://register.fca.org.uk/

Some advisors will be limited to a certain list of mortgage lenders to search from, some will search from a wider range. Ask the Mortgage Advisor if they are showing ‘whole of the market’ mortgage rates. But be aware there are mortgages that are only available if you go direct to the lender. Again, listen out from any friends or family who have recently bought and what mortgage they secured.

Mortgage advisor fees in Northern Ireland

Mortgage Advisors can charge a fee, some don’t and just earn the commission provided from the mortgage lender. Those who do charge a fee will also get this commission and may share this with you as ‘cash back’ as an incentive to use their services.

Questions you need to ask your mortgage advisor:

- What are my monthly repayments?

- Are these fixed or will they vary?

- What is the lenders normal variable rate?

- Could I come back to you and re-mortgage in a few years to find a better deal?

- Are there penalties for re-paying early?

- Can you provide guidance for my Home and Contents Insurance as well?

What you will need to bring to your mortgage advisor:

- 3 month’s Bank Statements for the previous 3 months

- Payslips

- P60

Your P60 is a summary of your pay for the year and the tax you have paid. Request this from your employer. These pieces of documentation on your finances allow the lender to see your income, but also your outgoings to measure your affordability in repaying the mortgage.

How much will your mortgage repayments be?

Find out what your mortgage repayments are likely to be by using an online mortgage calculator for example: www.moneysupermarket.com/mortgages/mortgage-calculator/

By inputting the property value, how much you need to borrow (which is the value of the property minus your deposit) and how many years you want to repay the mortgage. This will give you a good idea of how much your repayments will be every month. You can compare this total mortgage repayment amount to your current rent or mortgage payments to judge affordability.

How much should your deposit be for buying a house?

The best mortgage rates from lenders go to those with bigger deposits, which means your monthly repayments are lower. If you discover your monthly repayments are higher than you hoped, saving a little longer for a bigger deposit is usually the best idea. This will make mortgage repayments more manageable so you can happily enjoy your new home.

How much will it cost to move house?

Another very useful tool online is the Cost of Moving Calculator. This will add up an estimate of legal fees, stamp duty (if you are not a first time buyer in Northern Ireland), survey fees and removal fees to move your furniture from your current address. This is a great tool that enables you to have a realistic idea of the amount of money you will need just to get moved. You may need to set aside a small part of your deposit for this or save for a little longer. Buying a house usually takes longer than you think and costs more than you may expect. So do your homework and make sure you have no nasty cost surprises at the end.

Should I get a Survey before I buy a house?

Before completing on a house you can hire a Chartered Surveyor to asses the condition and value of the house. They will highlight any issues that may affect the purchase of the house; they really are worth the cost. They will check:

- Electrics

- Plumbing

- The roof

- Damp signs

- Subsidence signs

- Overall general condition of the house

There are no legal guarantees or warranties when buying a house, unless it is a new build and there is a Home Warranty and Insurance Scheme in place, which you will need to get details of. If you purchase a house and it turns out to have structural, electrical or heating problems, there are no remedies and you cannot be compensated by the seller or sue the seller, only unless it was a deliberate deception.

Surveys protect you as the buyer and also will be carried out in a brief form by the lender to ensure they are lending against a property with no issues.

There are 3 types of reports:

- Valuation Report

A valuation report is a basic survey and is the cheapest, costing from £100 to £250. This report is required by the lender to ensure that if a buyer defaults on their mortgage payments, the property could be sold for enough money to pay off the remaining mortgage. Some lenders may offer this valuation report free as part of the mortgage package.

A member of the Royal Institution of Chartered Surveyors or the Incorporated Society of Valuers and Auctioneers will be instructed to visit and report on the property. This will be organised by the lender with the seller or Estate Agent granting access to the home.

The valuer’s job is to compare the price of the house with the value of other houses in the area. They will also look for any obvious repair or structural problems. These inspections usually only take half an hour or less and should not be relied up on as a thorough examination of the condition of the house.

- Homebuyer’s Valuation Report

The Homebuyers Valuation Report is a more detailed survey suitable for conventional properties in reasonable condition. Costs start at £400 on average.

This is prepared by a member of the Royal Institute of Chartered Surveyors and requires a thorough inspection of the property. The visit may be for one to two hours and a detailed written report of perhaps up to fifteen pages will be produced. The interior and exterior condition and services, planning, building control and legal issues are reported on.

A summary of both the present condition and recommendations concerning future maintenance are given. An assessment of the open market value and a recommended insurance cover figure is also given.

However no assumption of risk or recommendation to purchase is made. You will be provided with more information upon which to make a final judgment, although further reports or estimates from electricians, plumbers, heating engineers, timber treatment companies, roofers or builders may still be necessary if recommended within this report . The fee could be anything from £300 to £750 depending on the value of the property and the time taken by the surveyor.

- Structural Survey

A Building or Structural survey – this is the most comprehensive survey and is suitable for all residential properties especially older homes or homes of non-standard construction. This survey typically costs upwards of £600.

This is carried out by a Structural Engineer and is usually only commissioned to investigate specific problems identified in a Valuation Report such as cracking of external walls or unevenness in the roof.

If the dreaded happens and a survey reveals problems with the property, you can either withdraw your offer at this stage and start to look elsewhere or, if the problems can be remedied for an estimated cost. You can use this to request a reduction in the price to cover the required work, or ask if the seller would undertake the work before you purchase.

Choosing a Solicitor in Northern Ireland

After you have got your mortgage approved by your mortgage advisor you will need the help of a Solicitor. When buying or selling a house in Northern Ireland, a solicitor oversees the legal process of the transfer of land into your name. This is called Conveyancing.

Solicitor’s fees in Northern Ireland

Traditional mortgage advisor fees are 1% of the house price plus an hourly rate. Remember VAT (Value Added Tax) will also be added on at the end. When buying a house in Northern Ireland this is 20%.

Ask for a written quotation from a few solicitors. In addition, it is always good to get some referrals from family and friends who have used a good Solicitor in the past for buying or selling a home. Remember, if you have a property to sell, you will have to pay the solicitor twice – once for the sale of your old home and then for the purchase of your new home.

What does my solicitor do when selling a house?

Your solicitor is responsible for a great deal of work in the buying or selling of a house:

Requesting and examining:

- Current ownership documents

- Reports on Water/Roads/Sewers/Rights of Way

- Bankruptcy charges or court judgements against the seller

- Land registry documents

- Searches on the property

- Details on you as the buyer on the lenders behalf, such as identity and checks on your background

- Settling fixtures and fittings to remain in the property

- Drafting forms, registering and transferring documents between the lender, seller’s solicitor, land registry and the buyer

- Paying the funds of the mortgage and deposit to the seller’s solicitor upon completion

Additional legal fees on top of your Solicitor’s fee also need to be added on. These fees are for Land Registry and Stamp Duty.

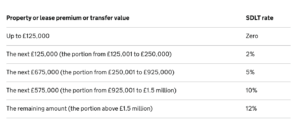

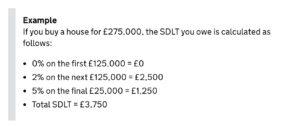

Stamp Duty Land Tax table for Northern Ireland

Stamp Duty must be paid unless you are a first time buyer in Northern Ireland. When buying a house in Northern Ireland, first time buyers are now exempt from Stamp Duty. See below table for the rate you will need to pay:

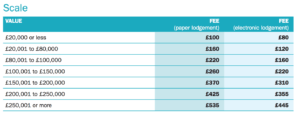

Land Registry fee guide for Northern Ireland

Once you have completed the purchase your house, your solicitor will carry out registration formalities at the Land Registry or Registry of Deeds on your behalf. This involves registering you as the new owner of the property along with any mortgage you have obtained. Fees may vary depending on whether the property is registered in the Land Registry or Registry of Deeds. Once your solicitor receives the Title Deeds from the seller’s solicitor at the start of the conveyancing process, the fee can be confirmed.

Completion Day!

Once you have got to this stage of buying a house in Northern Ireland, it should all be plain sailing! On the day of completion your Solicitor will pay the mortgage funds to the seller and you will likely collect your new keys from the Estate Agent. All that’s left is to go and open the door to your brand new home!

View our collection of new build homes currently for sale: Huntingdon Hill